Morpheus, Decentralized AI Project From Lumerin, Goes Live on Arbitrum Test Network

December 21, 2022Trading account types compared: assets, benefits, conditions

January 12, 2023

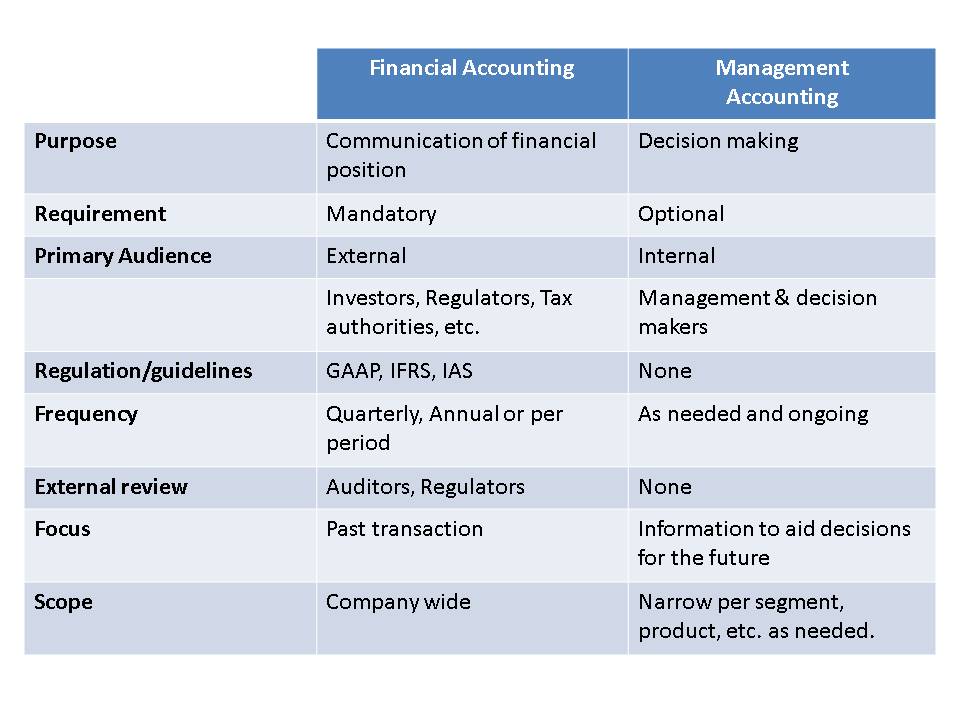

In fact, accounting is often referred to as “the language of business” because business peoplecommunicate, evaluate performance, and determine value using dollars and amounts generated by the accounting process. For example, a midsize manufacturing company needs to constantly track trends, unit costs and other information to succeed. A small service business, on the other hand, may benefit from simple targeted information, such as overhead costs and break-even points. By learning about management accounting, you can determine what accounting level, types and functions can help your business succeed. The major difference between the two accounting types is that management accounting focuses on strategic decision-making within a company, while financial accounting provides analysis for external use.

What is the approximate value of your cash savings and other investments?

The main function of any good managerial accounting team is to support its company with accurate, relevant, and timely information. This information is important for ensuring decision-makers know everything they need to know to direct the company toward its goals. Managerial accounting is a rearrangement of information on financial statements and depends on it for making decisions. So the management cannot enforce the managerial decisions without referring to a concrete financial accounting system. Internal management accounting systems are used to provide critical information to management to be used in operational business decision-making.

- Separating them out allows managers to focus on controllable costs that should be monitored in order to contain or lower them.

- Management accounting is concerned with preparing and presenting accounting information in such a way as to assist a firm’s management in designing policies, planning, and controlling the operations of the undertaking.

- It prepares you for a career in accounting leadership by demonstrating your competencies in the key skills hiring managers look for in candidates.

- The use of qualified professional accountants or a CPA who has prior experience in franchise accounting assists in audits and reporting, and performance improvements.

- Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact…

What are the challenges of management accounting?

This figure includes an average base salary of $90,606 and $20,908 in additional pay. Cash flow analysis studies the impact of a single financial decision or transaction to see the true impact of that purchase or decision. Financial professionals may look at several options and ways to finance a purchase based on that analysis. Cash flow analysis lets organizations make informed financial decisions and maintain sufficiently liquid assets in the short term.

Become an Industry Leader With CMA Exam Academy

For any given product, customer or supplier, it is a tool to measure the contribution per unit of constrained resource. Management accountants produce dedicated reports to serve the needs of decision-makers. last-in first-out lifo method in a perpetual inventory system Past and current activities are reported to the extent that such information helps management to plan for the future. Management accounting is specific to strategic decision-making based on company finances.

How confident are you in your long term financial plan?

Graduate degrees are not always required but may be required for some senior-level managerial accounting positions. Each employer may have their requirements, so it’s important to research the desired qualifications before pursuing your degree and applying to entry-level positions. In a supervisory position, controllers oversee all aspects of the financial health of an organization, organizing reports, analyzing financial data, and creating strategic plans and goals. Managerial accounting is important for drafting accurate and complete financial statements for internal use and crafting a company’s long-term strategy.

Managerial accountants perform cash flow analysis in order to determine the cash impact of business decisions. Most companies record their financial information on the accrual basis of accounting. Although accrual accounting provides a more accurate picture of a company’s true financial position, it also makes it harder to see the true cash impact of a single financial transaction.

These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. Accounting managers work to ensure the timely delivery of financial reports to an organization’s decision-makers. This role ensures the accuracy of reports, manages the performance of other accountants, and allocates tasks among other accountants. Managerial accounting is a specified type of accounting that has different job titles based on the company, industry, education, location, and more. The job titles often differ in salary and responsibilities, though you’ll find some common tasks and skills in most jobs in managerial accounting.

According to BLS job outlook data for accountants and auditors, management accountants often advance into high-level executive positions and controller roles. A management accounting concentration can help position accountants for such advancements. Management accounting’s emphasis on using accounting for business decision-making prepares students for high-paying financial management roles within organizations. By examining business strategy and analytics, management accounting concentrations also position graduates for consulting careers.